A New Era for Financial Market Efficiency, Beginning with On-Chain Origination

Introduction

In a world of ever-expanding complexity, the need for efficiency, security, and transparency is increasingly pressing. One of the most important areas in need of innovation is the infrastructure that underpins our financial systems. Blockchain technology has the potential to offer transformative advancements for the financial system in general, and the fixed income market specifically. However, for the benefits of blockchain technology to be fully realized in the fixed income market, it is essential that we begin the transition at the point of origination – not in the middle when the trade economics and records are already set.

Origination is the foundation of any financial instrument, and in the case of fixed income securities, it sets the stage for the entire lifecycle of the asset. By originating debt directly on blockchain, we establish a base to conduct all subsequent transactions within a secure, immutable, and transparent environment. This shift is crucial for facilitating the seamless transfer of value, reducing reconciliation friction, and enhancing the overall security of financial data.

At the heart of this process lies the concept of atomic transactions. An atomic transaction is a type of transaction that is indivisible and irreversible. In the context of blockchain, it means that a transaction either happens in its entirety or not at all, with no intermediate states. This ensures that all parties involved in a transaction can trust that once a transaction is executed, it is final and cannot be altered. This level of security and certainty is paramount in the financial markets, where the cost of errors can be substantial.

An atomic transaction is indivisible and irreversible.

In contrast, a non-atomic transaction is prone to fragmentation, heightening the risk of incomplete execution. Fragmentation arises due to multiple handoffs during the transaction process. In the traditional financial system and on permissioned blockchains, this means that transactions can occur in segments, creating intermediate states. These intermediate states, representing partial completion, introduce potential errors and failures, leading to inefficiencies such as the need for “batching” to achieve netting and reconciliation. This fragmentation significantly increases the risks associated with transaction execution.

Today’s fixed income infrastructure is a non-atomic batching system where trades are accumulated at set intervals, typically daily, and during these intervals various risks accumulate. The most significant of these is counterparty risk or the risk of failed trades. To address counterparty/fail risk, two mitigation processes are used – a central counterparty (CCP) and multilateral netting.

The current batch-based system for trade settlement was developed fifty years ago and reflects the technological constraints at the time. Current settlement is dominated by the Depository Trust & Clearing Corporation (DTCC) – a single central choke point – designated as a Systemically Important Financial Market Utility (SIFMU) by federal financial regulators because its failure could threaten the stability of the US financial system.

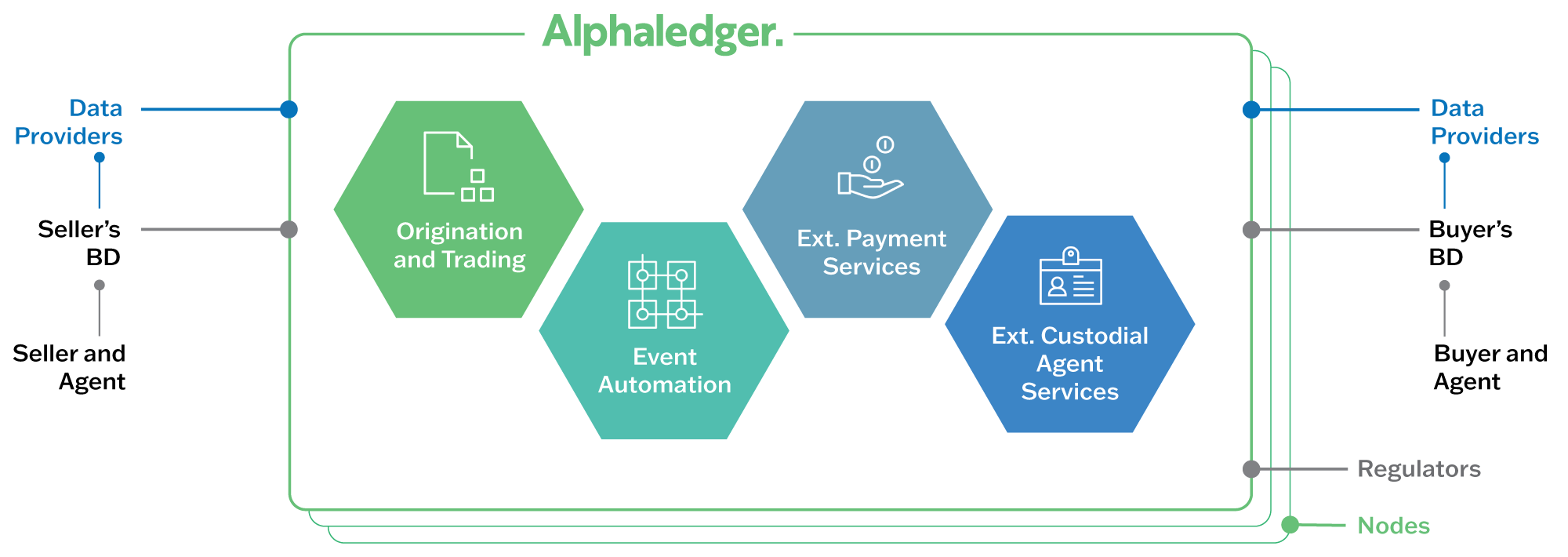

With increasing regulatory requirements, the shortening of settlement cycles, and evolving market demands, we need to look ahead to anticipate market needs. Rather than piecemeal automation solutions, Alphaledger is harnessing the power of purpose-built technology to implement atomic transactions.

By originating debt on the blockchain through atomic transactions, we can create a robust foundation that supports the entire lifecycle of an asset, from issuance to trading, settlement, and beyond. This approach not only streamlines operations but also lays the groundwork for a more secure and efficient financial ecosystem.

Alphaledger has positioned itself at the forefront of this transformation by utilizing blockchain network infrastructure for the origination and settlement of primary originations in fixed income markets. This infrastructure is designed to support the most efficient transfer of value possible, leveraging blockchain technology to streamline and secure transactions.

This paper compares the efficiency of blockchain atomic transactions with the non-atomic / batched functions of DTCC, highlighting the strengths and weaknesses of each approach.

Blockchain Atomic Transactions: The New Standard in Efficiency

The concept of “state” is crucial in understanding the difference between atomic and non-atomic transactions. Atomic transactions ensure that the state remains consistent by either completing all steps or none at all, thus preserving data integrity. In contrast, non-atomic transactions can result in multiple state changes, which may lead to inconsistencies if not carefully managed. This distinction is vital for maintaining the reliability and accuracy of operations in distributed systems and blockchain networks.

The future of fixed income is atomic!

Varied states in a non-atomic transaction can introduce risks, due to the potential for inconsistency or failures when transitioning states. The various forms of risk include settlement, counterparty, inefficient use of capital, legal and compliance, and reconciliation, which can lead to financial losses, regulatory issues, and operational challenges. Understanding and managing these risks is critical for ensuring the reliability and integrity of financial transactions.

Permissioned Networks and Data Resiliency

Permissioned blockchain network infrastructure – a “walled garden” – offers a highly trusted environment. In this type of network, multiple copies of reconciled data are provided to all approved participants, ensuring data consistency and reducing potential errors. The key advantage of this system is that it allows only the parties involved in a transaction to access the same network, thereby eliminating the need for time-consuming reconciliations that plague traditional systems.

However, due to the inherent limitations of a permissioned network, it is not possible to execute a single atomic transaction that spans multiple payment networks simultaneously. This constraint necessitates separate transactions for each payment network, potentially impacting overall transaction efficiency and synchronization. Additional critical drawbacks include:

- Adoption – Market participants must adopt each other’s infrastructure, much like creating a trusted network.

- Fragmentation – No standard for infrastructure development and deployment.

- Inconsistency – No standard for atomic transactions.

- Expensive – High cost of maintenance and deployment.

For these reasons, only a network built on a public blockchain is capable of delivering the full benefits of atomic transactions.

Public Blockchain: Resiliency in Record Keeping and Cybersecurity

Public blockchains, by design, offer unparalleled resiliency in record keeping. The distributed nature of these networks ensures that multiple identical copies of every transaction and record are stored across numerous nodes globally. This decentralization makes the blockchain inherently resistant to data loss, tampering, or single points of failure, creating a robust and reliable system for maintaining financial records.

In a world where the integrity and availability of financial data are crucial, public blockchains provide a level of redundancy that is difficult to match with traditional centralized systems. This resiliency is particularly valuable in the context of disaster recovery, where the ability to quickly restore access to accurate and up-to-date records can make the difference between continuity and disruption.

Cybersecurity Strengths

Public blockchains are fortified by advanced cryptographic techniques that ensure the security of transactions and data. Each transaction on the blockchain is secured through encryption and linked to the previous one, forming an immutable chain of records. This immutability makes it virtually impossible for malicious actors to alter past records without detection, providing a high level of cybersecurity that surpasses traditional financial systems.

Moreover, the decentralized nature of public blockchains means there is no central point of attack, making them less vulnerable to hacks or breaches. In contrast, centralized systems like those operated by the DTCC remain susceptible to targeted cyberattacks, which could compromise the security of vast amounts of sensitive financial data.

Misunderstanding of Privacy Concerns

One common misconception about public blockchains is the perceived lack of privacy. While it is true that transactions on a public blockchain are transparent and can be viewed by anyone, this does not equate to a lack of privacy for the participants.

Transparency does not equate to lack of privacy.

Public blockchains use pseudonymous addresses instead of real-world identities, meaning that while the transaction details are visible, the identities of the parties involved are not readily apparent.

Furthermore, advanced privacy-enhancing technologies, such as zero-knowledge proofs and confidential transactions, are being developed and implemented on public blockchains to further enhance user privacy. These technologies allow transactions to be verified without revealing sensitive information, ensuring that privacy concerns are addressed while maintaining the transparency and security that make blockchain technology so powerful.

Foundation for High-Performance Delivery Versus Payment (DVP)

The Alphaledger blockchain platform is purpose-built for the origination and high-performance settlement of regulated fixed income assets, and is designed for speed, reliability, and maximum efficiency. By leveraging a public blockchain with built-in liquidity through multiple stablecoins, Alphaledger seeks to ensure secure and efficient transaction processing. A key differentiator is Alphaledger’s focus on the Delivery Versus Payment (DVP) process, which enables simultaneous gross settlement of securities and funds transfer. This eliminates the need for netting or end-of-day reconciliation, significantly reducing settlement time and risk. The ability to settle at the time of trade execution offers near-instantaneous finality, ensuring the most efficient transfer of value.

The Inefficiencies of Batched (Non-Atomic) Delivery Versus Payment (DVP)

The DTCC plays a central role in the U.S. securities industry, providing clearing, settlement, and information services for a wide range of securities. This centralized approach has inherent inefficiencies, which are directly related to the batching structure of trade settlement. To mitigate counterparty / fail risk associated with batching, two processes are utilized – central counterparty (i.e. street name) and multilateral netting.

Cede & Co., acting as the legal owner of securities on behalf of the DTCC’s subsidiary, the Depository Trust Company (DTC), holds securities in its name for the benefit of the actual owners. This intermediary role, while established as an industry standard, is not without its drawbacks. The centralized custody and clearing function results in monopoly conditions, creates a systemically risky single point of failure, and creates substantial limitations on innovation.

Limitations of DTCC’s Blockchain Adoption

While the DTCC has taken steps to optimize its operations by acquiring a blockchain firm, this effort falls short of the full potential of blockchain technology. The DTCC’s approach focuses on optimizing existing clearing and settlement functions rather than fully embracing distributed trade execution and settlement. Consequently, the benefits of blockchain—such as reduced settlement times, lower costs, and enhanced security—are not fully realized within the DTCC’s current framework.

Non-atomic settlement processes also introduce several inefficiencies that can impact broker-dealer activities. Delayed settlement periods, operational complexity, higher costs, settlement risks, inefficient use of capital, regulatory compliance challenges, and limited flexibility all contribute to a less efficient trading environment. These inefficiencies underscore the potential benefits of adopting atomic settlement processes enabled by blockchain technology, which can provide faster, more secure, and cost-effective solutions for broker-dealers.

Comparative Analysis: Atomic vs Batched Settlement

Efficiency of Realtime Blockchain Atomic Transactions

- Speed: Blockchain atomic transactions enable near-instantaneous settlement, drastically reducing the T+X (1-10 days) timeframe during origination to T+0 or T-Now™. This eliminates cash drag at the point of origination, where settlement processing is the longest.

- Security: With all participants accessing a single, immutable ledger, the potential for errors is minimized, and the risk of fraud is significantly lower.

- Cost: By removing intermediaries and reducing the need for reconciliation, atomic blockchain transactions lower the overall cost of trade settlement.

Inefficiency of Non-Atomic Batched Settlement

- Delay: The T+X settlement process introduces unnecessary delays, creating settlement risks and increasing the cost of capital for market participants.

- Concentration: The centralized nature of the DTCC, coupled with its reliance on intermediaries like Cede & Co., results in monopoly conditions and creates a systemically risky single point of failure.

- Limited Innovation: While the DTCC has made some strides in adopting blockchain technology, its efforts are constrained by its traditional operating model, preventing the full realization of blockchain’s benefits.

Conclusion

Alphaledger’s blockchain-based atomic transaction model offers a compelling alternative to the traditional DTCC settlement process. By leveraging blockchain, Alphaledger seeks to provide a faster, more secure, and cost-effective solution for trade origination and settlement. In contrast, the DTCC’s centralized, non-atomic approach remains burdened by inefficiencies and unnecessary risks. As the financial markets continue to evolve, the shift towards blockchain and atomic transactions will take root, offering significant benefits to all market participants and the overall US financial system.